Stickier inflation, a relatively healthy labour market and a barrage of stronger US economic data have forced the market to reconsider its aggressive Fed expectations and to price in only two rate cuts for 2024.

Despite the surging US yields, which make lending more expensive especially for the smaller corporates, US stock indices recorded new all-time highs, partly on the back of the AI craziness that is expected to benefit their accounting bottom lines, as the US economy proves to be ahead of the herd.

However, the recent US CPI report has alarmed the market about the possibility of the Fed not cutting rates this year and thus prompted the current stock market weakness.

Is the US economy strong enough to justify keeping rates unchanged? Putting aside the most popular business indicators, a plethora of second-tier business surveys covering both the services and manufacturing sectors have been examined. These surveys tend to cover specific US regions and are mostly compiled by the local Federal Reserve Banks.

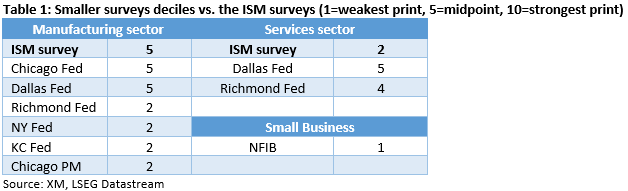

For comparison reasons, deciles have been produced for these surveys and they are compared to the key ISM surveys. These deciles are based on the March 2020-March 2024 period which captured the Covid crash, the recovery that led to the aggressive rate hikes and the current preparatory period for the expected Fed rate cuts.

The deciles vary from 1 to 10, with 1 being the weakest print compared to the 4-year period, 5 being around the midpoint of this range and 10 meaning the best print of the examined range. Therefore, 1 means it is near or at the lows of the four-year period, 10 means the survey’s index is at or near its four-year high and that 5 means it’s around the middle.

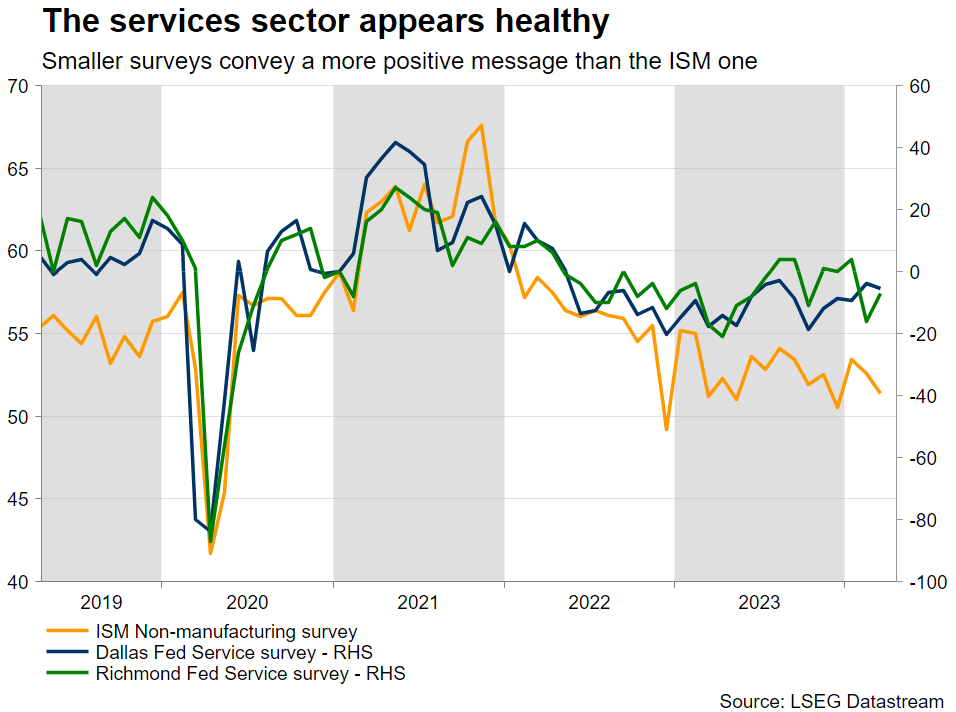

Services sector surveys

Two surveys from the Dallas and the Richmond Federal Reserve Districts are published monthly for the services sector – the largest part of developed economies. Despite the tighter financial conditions, these surveys point to a sector achieving average performance, matching partly the message from the recent Beige book. Interestingly, these second-tier surveys convey a more positive message than the dominant ISM non-manufacturing survey, and could explain the ongoing strong US growth and the recent stickiness in services inflation.

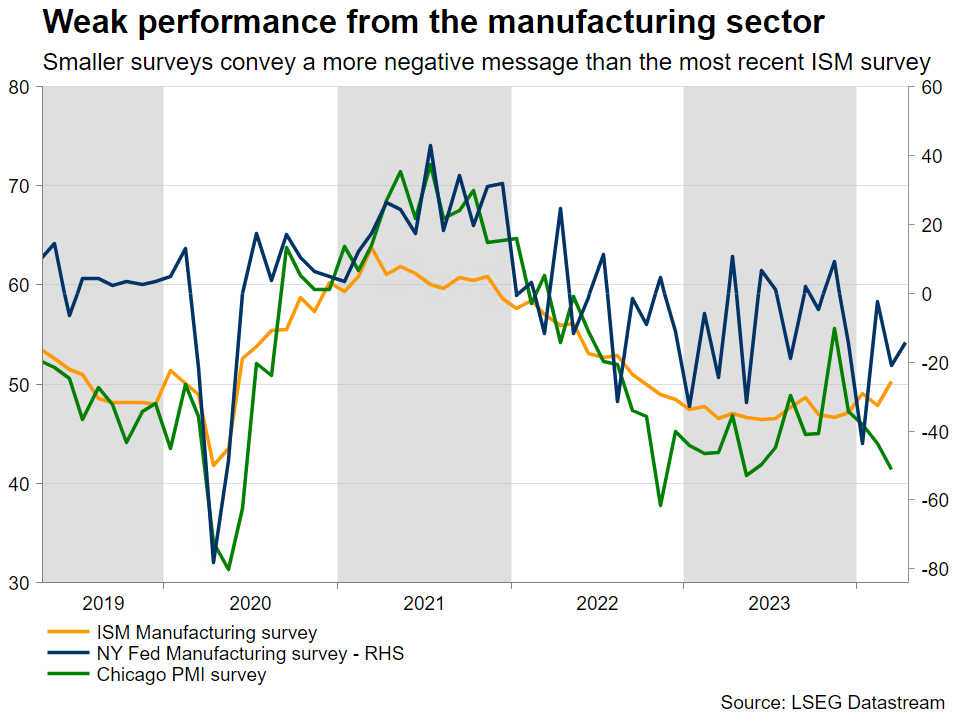

Manufacturing sector surveys

While being a much smaller part of the US economy, the manufacturing sector still holds significant value as a leading indicator. A plethora of small-scale surveys is published every month, mostly by the regional Federal Reserve banks including the New York Fed. The overall message is that the manufacturing sector is achieving sub-par performance and thus portraying a more negative message than the most recent ISM manufacturing survey print.

Small businesses’ outlook

On a slightly different approach, the NFIB business optimism survey is probably one of the most known smaller surveys in this report due to the importance of small businesses to every economy. This survey does not tend to be market moving but it is currently at a very low decile. This means that its latest print is at the lower end of the four-year window and thus clearly points to economic weakness ahead for small businesses.

To sum up, these second-tier surveys point to a more mixed US economy than the market’s current thinking. The services sector appears to be relatively healthy, and thus pointing to continued inflationary pressures, while the manufacturing sector is probably experiencing lower growth than currently portrayed by the established ISM surveys. The situation in the manufacturing sector could offer the Fed the appropriate excuse to commence its rate cut cycle ahead of the November presidential election.Dollar benefits from stronger US data

The strength of the US economy has resulted in a sizeable outperformance of the dollar against its main trading partners. For example, dollar/loonie reached a new five-month high and dollar/yen is trading a tad below the 155 level, which is the market perceived threshold for an actual intervention by the Japanese authorities.

Interestingly among the dollar crosses, the pound/dollar pair has finally managed to break decisively lower below a five-month long tight rectangle. Economic divergence between these two economies has become more pronounced lately, even though both continue to face elevated inflation. Should the US economy continue to grow respectably, the current downside pressure seen in pound/dollar could pick up speed with the October 2023 low at 1.2036 becoming a credible target.