The Chinese economy is in the doldrums. The post-pandemic bounce back was too brief to sustain. Consumer sentiments are low. The common Chinese are investing in gold instead of stocks and other financial instruments in an apparent show of distrust in the country’s economic trajectory. Beijing reported 5.2% growth in 2023 but the Rhodium Group analysts questioned the credibility of the numbers. Rhodium offers China-specific research. On top of all, China’s plan to be a technology superpower is seriously harmed by tough restrictions imposed by the US-led West in denying Beijing access to cutting-edge microchip technology.

Microchips are the nerve centre of any modern machinery. From mobile phones, and automobiles to aeroplanes everything runs on those printed circuits on a small piece of plastic. It is the performance of the microchip that determines the precision strike by a ballistic missile. The thinner the microchip, the more efficient it is. And, it is the efficiency of microchips that holds the keys to industrialisation in the days of automation and artificial intelligence (AI).

According to a report in The Atlantic, the newest AI chip developed by the U.S. giant Nvidia is 16 times faster than the 7-nanometer chip unveiled by the Chinese telecom major Huawei in September 2023. Huawei has been facing US sanctions since 2019, thereby losing access to the 5nm chips produced by Taiwan’s TSMC under US backing. TSMC is already mass-producing 3nm chips for American and European companies.

The problem is not merely in developing chips. The West not only controls the chip market but also the chip manufacturing equipment market. “In 2022, the Joe Biden administration barred American companies from selling the most advanced chips and chip-making equipment to China without a special license, effectively isolating the Chinese tech sector. Biden also persuaded its allies Japan and the Netherlands—the two other leading sources of semiconductor machinery—to introduce their own bans. The Biden controls also prevent other foreign chip-making firms that use U.S. technology, such as TSMC, from producing advanced chips for Chinese firms,” The Atlantic said.

The net result is China is producing a much inferior 7nm chip at double the cost of the American, Japanese, or Taiwanese companies. Obviously, the loss of the Chinese market hurts Western corporates. The Wall Street Journal recently reported how ASML of the Netherlands is caught in the US-China chip battle. But, rest assured the West will not loosen its grip. The reason lies in their past experiences.

Though China was never a liberal economy, the US-led West paved the way for its entry to the World Trade Organisation (WTO) governed free trade regime. The result was catastrophic. Beijing ensured layers of subsidies for its manufacturing, which were not easily recognisable due to China’s opaque systems. Goods were dumped in the world market at below market price. The democratic world paid a heavy price for ensuring transparency. The automobile manufacturing hub of Detroit in the US became a ghost town as companies shifted production bases to China. American industry kept creating wealth and jobs for China and, the totalitarian regime used that money to pursue neo-colonialist goals including threats to a democratic Taiwan.

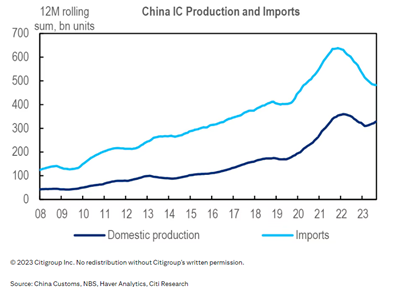

The past is now catching up with China as the US-led West is determined to cut Beijing’s access to the latest chip technologies which will rule tomorrow’s manufacturing and even security. A recent report titled “Emerging resilience in the semiconductor supply chain” by Boston Consulting Group points out that China will manufacture domestically only 2% of the world’s advanced chips in 2032. It means, there is a serious headwind to future manufacturing growth in China. Considering that the future production processes will be highly AI-driven, a lack of access to the latest semiconductors may rob China of its status as the ‘factory of the world.’ To put it differently, China can no longer bank on the export-led growth model.

President Xi Jinping is fully aware of the trouble ahead. The Chinese Communist Party wanted domestic consumers to create demand for its factories. But that’s not happening. To add to the trouble, Xi’s high-handed tactics have ruined the confidence of its private sector. In his quest to consolidate power, Xi harassed prominent tech companies and entrepreneurs. This did not augur well. “These fears translate into weak consumer demand, restrained business investment, and efforts to move wealth and family abroad,” Scott Kennedy wrote in Foreign Policy magazine. Scott is a senior adviser and Trustee Chair in Chinese Business and Economics at the Center for Strategic and International Studies.