China remains among the largest global economies, but it faces significant economic headwinds. The country’s real gross domestic product (GDP) growth, a common economic activity measure, slowed from double-digit annual increases during the 2000s to 5.3% in this year’s second quarter. Nevertheless, China remains a major global trading partner and ranks as the second-largest economy worldwide, trailing only the United States.

’s agenda emphasizes reframing Chinese trade relations. To reduce dependence on Chinese-made goods and promote domestic manufacturing, President Trump implemented varying on Chinese imports. Early in the new administration, the U.S. added 10% tariffs to China. That quickly doubled to 20% and eventually totaled 145%, threatening to cripple trade activity.

On May 11, 2025, the United States and China announced a 90-day agreement reducing U.S. tariffs on Chinese goods to 30%. This agreement was recently extended for an additional 90 days through November 10. During negotiations, China reduced tariffs on imported U.S. goods to 10%, from the previous 125%.

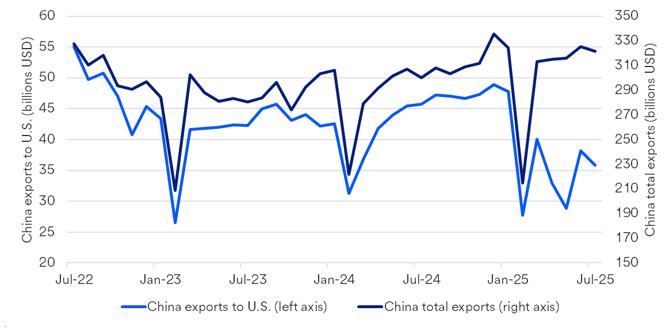

China’s slowing freight activity to the U.S.

By modernizing its economy in the 1980s, China quickly emerged as a global economic power, leveraging a skilled labor pool, infrastructure investments and low-cost production. Exports drove the country’s economic ascendence, leading to rapid middle-class population growth. Entering 2025, the U.S. was the largest customer for Chinese goods.

In today’s environment, the Trump administration’s focus on reducing Chinese imports could negatively impact China’s economy. However, China increased total exports in recent months, with gains in Europe and Latin America offsetting slowing exports to the U.S.

China total exports to U.S. and the world

.

“China hopes it can replace U.S. business by stepping up exports to other countries,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management Group. For China to accomplish this, it must sell more goods to Southeast Asia, Latin America and Europe.

China’s government actively pursues policies to boost manufacturing activity, including consumer incentives for replacing durable goods like washing machines. China also competes technologically in global markets. Notably, China-based electric car maker BYD has now surpassed Tesla in total electric vehicle sales.

China’s property overhang

China’s property crisis emerged in 2021 and remains an acute economic headwind. Easy local government credit and home builders’ overdevelopment led to housing market oversupply, creating a potential financial crisis for the country. Home prices fell in response to excess supply, pressuring construction activity. Previously, surging property development boosted China’s rapid growth rate, accounting for close to one-third of GDP.

So far in 2025, retail sales are up compared to 2024 growth rates, but it’s unclear whether this trend is sustainable. “Consumers have some capacity to spend more in China,” says Haworth. “Even though the economy isn’t booming today, it is still growing.” However, other economic data signals ongoing strains. China’s year-over-year consumer inflation rate ranged between -1% and +1% the last two years, while Chinese10-year government bond yields fell from 2.6% at the beginning of 2024 to a low of 1.6% in early 2025, before rising slightly to 1.7% as of August 14. Both metrics suggest sluggish current activity and subdued future growth expectations. Additionally, China routinely suppresses unflattering economic data, such as youth unemployment, indicating other areas of economic struggle.

Investment challenges and opportunities

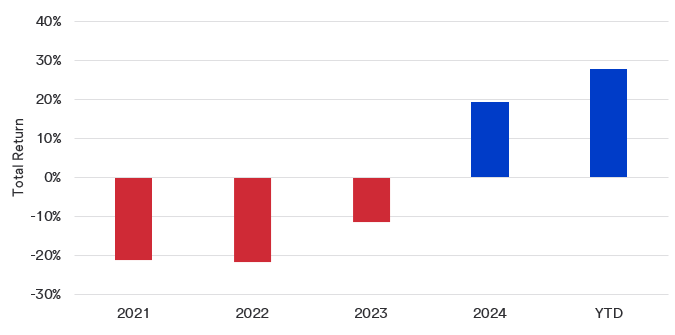

China’s equity markets faced challenges throughout most of the 2020s. After a three-year losing streak from 2021 to 2023, stocks, as measured by the MSCI China Index, rallied in 2024. A weakening fueled additional gains in 2025 by increasing China equity market returns for U.S.-based investors. By mid-August 2025, however, the MSCI China Index remains 36% below its February 2021 peak.

MSCI China Index: Total Returns 2021-2025

“Any investor who puts money to work in a broad, emerging market index likely owns a significant position in Chinese stocks.”

–

Rob Haworth, senior investment strategy director for U.S. Bank Asset Management Group

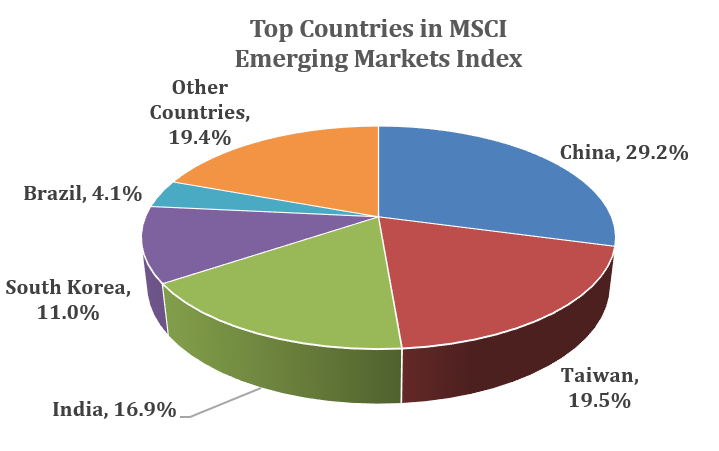

Despite China’s global economic largess, investors still classify China as an emerging market. Within that category, China holds the largest single country weight in the MSCI Emerging Markets Index, representing more than one-quarter of the index. “Any investor who puts money to work in a broad, emerging market index likely owns a significant position in Chinese stocks,” says Haworth.

In 2024, the MSCI Emerging Markets Index generated a 7.5% total return, outpacing the MSCI EAFE developed markets index, while significantly underperforming U.S. markets. By comparison, the S&P 500 earned a 25.0% total return last year. Global market performance is up in 2025, with the MSCI Emerging Markets Index rising 20.4% through August 15 on a total return basis, compared to the S&P 500’s 10.6% total return.

Investing in international stocks

International stocks should be part of a well-diversified portfolio. “We believe global stocks are an attractive investment opportunity,” says Haworth.

Haworth suggests that a broad emerging market allocation, featuring some Chinese stocks, can effectively diversify your portfolio with exposure to China’s market. Additionally, emerging market indices offer broader sector diversification than U.S. counterparts. “Today, compared to the past, we find more manufacturing and exporters across emerging market economies,” says Haworth. “Many of these manufacturers outside of China may benefit from U.S.-China trade fallout.”

Any changes to your investment strategy should be consistent with your goals, time horizon and risk appetite. Talk with your U.S. Bank to review your current financial plan and determine whether there is an opportunity to incorporate emerging market stocks – with exposure to China – into your broader, well-diversified portfolio.

Note: The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 568 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization. The MSCI Emerging Markets Index captures large and mid-cap equity performance across twenty-four emerging market countries. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.