As an important instrument for infrastructure financing, Public-Private Partnerships (PPPs) have been widely utilised by the Chinese government. China Finance Review International (CFRI) brings you an article titled “Determinants for the Desirability of Public-Private Partnership Mode in Infrastructure Development”, which examines the factors that influence the success and failure of PPP projects in China. With nearly 14,000 PPP projects proposed between 2009 and 2022, representing over 20 trillion yuan in investment, the study addresses growing concerns about local government implicit debt and the need for more sustainable partnership models.

Methodology and Scope

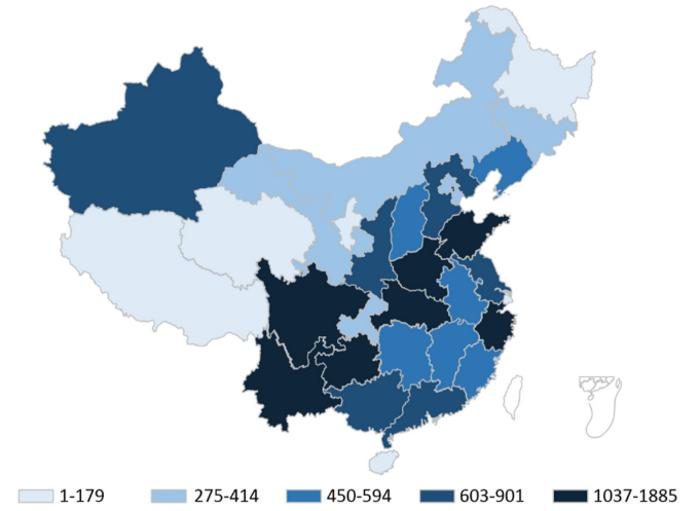

Using a manually collected dataset of over 12,000 PPP projects from 2019 to 2022, the author analyses project transitions and terminations to identify signals of PPP desirability. The study employs probit regression models to assess the impact of project characteristics, such as ownership structure, revenue schemes, and industrial features, on successful execution and abnormal termination. Special attention is given to the role of state-owned enterprises (SOEs) and private firms within the social party of PPPs.

Key Findings and Contributions

- Execution-stage projects in sectors requiring strong government support (e.g., transportation, urban development) or where quality trumps cost efficiency face higher termination risks, unless SOEs are part of the social party.

- Social party structure matters: Private firm involvement increases termination likelihood, while a more decentralised social party reduces it.

- Pre-execution projects with government payment or gap subsidy schemes are more likely to advance to execution.

- The study provides the first large-scale empirical test of PPP theories in the Chinese context, highlighting the unique stabilising effect of SOE involvement in socially critical industries.

Why It Matters

This research comes at a critical time when Chinese policymakers are actively managing PPP-related fiscal risks, as reflected in recent regulations like State Council Policy [2023 No. 115]. The findings offer evidence-based insights into how ownership and financing structures affect project survival, especially during economic downturns or systemic shocks such as the COVID-19 pandemic.

Practical Applications

The study suggests that PPP regulations, particularly those governing SOE participation, should be tailored to industry-specific needs. For example, in sectors where government support is indispensable or quality is paramount, SOE involvement can enhance project stability. Conversely, in less policy-sensitive sectors, greater private participation may be encouraged. These insights can help policymakers design more resilient and efficient PPP frameworks.