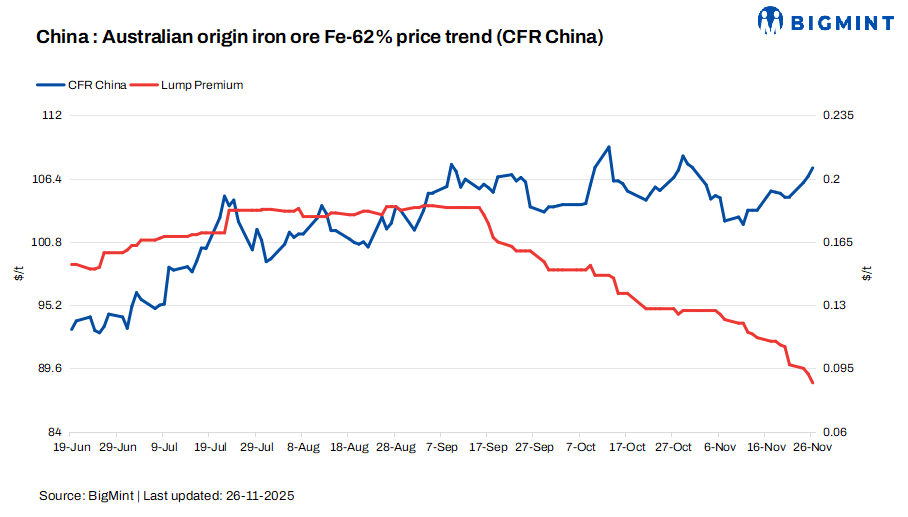

Premiums of China’s seaborne iron ore lump against 62% Fe fines, which have tracked downward since mid-September, have now hit a 1.5-year low. Behind the weak lump premiums has been waning demand for lump ores from loss-suffering steelmakers, Mysteel Global noted.

As of November 25, Mysteel SEADEX 62.5% Fe Australian iron ore lump premium against 62% Fe Australian fines had dropped to $0.0925/dmtu, plunging by 42.2% from two months ago and hitting the lowest level since late May 2024.

Iron ore lump is considered a premium product over fines as it can be charged directly into blast furnaces, saving sintering costs and reducing pollution. However, since mid-September, market sources have observed a notable decline in steel mills’ appetite for lump ores, alongside a growing preference for medium-grade fines.

An iron ore analyst based in Shanghai explained that many Chinese blast-furnace (BF) mills started to suffer losses on steel sales in September, and this prompted them to turn away from lumps to more cost-effective medium-grade fines to produce sinter ore.

For example, the 91 Chinese BF mills under Mysteel’s monitoring lost an average of Yuan 60/tonne ($8.5/t) on rebar sales during September, a major reversal from the Yuan 18/t profit they enjoyed in August. Their losses widened to Yuan 106/t in October, according to the latest data.

On the other hand, supply of lump ores has increased sharply over the past two months. China’s imports of lumps reached a record high of 21.3 million tonnes in September, jumping by 16.5% on month, according to data from the country’s General Administration of Customs. Although imports dropped slightly in October to 20.3 million tonnes, the volume still marked the second highest in history, the GACC data showed.

While weakening demand and growing supply have continued to pressure lump premiums, traders still found it hard to sell lump products lately, the source said, adding that this has led to a pronounced increase in the port inventories of the feed material.

On November 20, inventories of lumps stockpiled at China’s 45 major ports regularly tracked by Mysteel stayed elevated at 19.6 million tonnes, up by 17.4% from two months earlier.