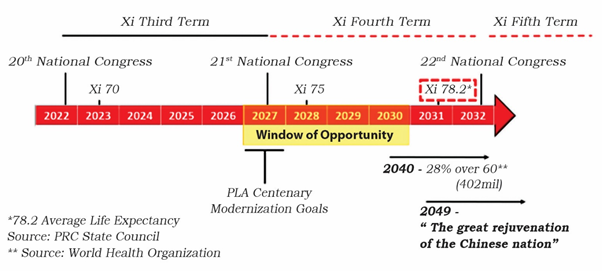

A recent tweet on Chinese strategy with regard to Taiwan is quite revelatory. A book titled “If China Attacks” being sold in Taipei was purchased by a NG activist named Cynthia Iuun. Sometime after she had purchased the book she started receiving calls from anonymous callers, obviously Chinese asking what she thought of the book. Clearly, a Chinese intelligence psychological warfare operation ahead of the Presidential Elections in Taiwan, the narrative also indicates the larger Chinese strategy for eventually reunited Taiwan with the Chinese mainland. The very task of estimating an eventual takeover by China is challenging to say the least. In this context, it is worth citing Derek Grossman who recently tweeted that, “Chinese President Xi Jinping bluntly told President Joe Biden during their recent summit in San Francisco that Beijing will reunify Taiwan with mainland China but that the timing has not yet been decided, according to three current & former US officials.” This makes it amply clear that President Xi has a plan, the only question that remains is the timing. Given this situation, it makes sense for India and the world to prepare for the worst. The economic hammer will fall hard, both directly and indirectly.

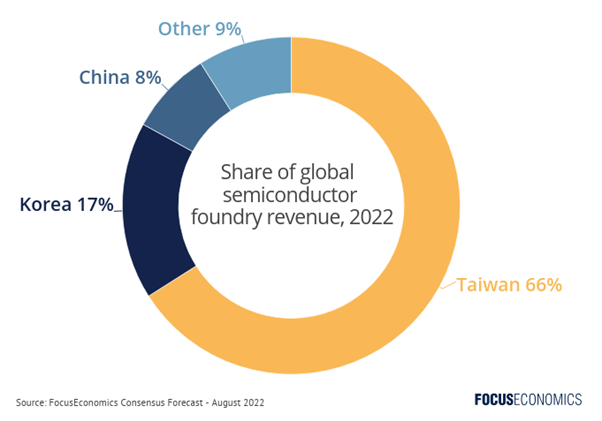

In this sense, a conflict over Taiwan could take many forms, varying in duration, scale, and in terms of the parties involved. Thus, estimating the economic implications for such an eventuality can only occur based on currently available data. Important aspects of disruption scenarios are not easily quantifiable and often left out of trade shock models, including impacts on cross-border flows of people and ideas. The ripple effects from trade and supply chain disruptions are also very difficult to estimate. In the event of a blockade, the most significant disruption to global economic activity would be the halt to Taiwan’s trade with the world, particularly in semi-conductors. Associated disruptions to global supply chains, especially in major chip-consuming sectors such as electronics, automotive, and computing, would have grave worldwide economic repercussions. China’s global trade would also decline due to a contraction in global trade financing, shocking the global economy and potentially triggering debt crises among China’s more fragile trade partners.

Why is Taiwan important today? It is a strategic hub in global electronics supply chains, with 53% of its exports by value in 2021 being electronic components and technology products. While China is Taiwan’s main trading partner, accounting for 28% of these exports, the U.S. (15%), Europe (9%), Japan (7%), and Singapore (6%) are also significant importers. Pertinently, more than 23,100 U.S. companies buy directly from Taiwanese suppliers at tier-1, while more than 112,500 buy indirectly at tier-2, and over 237,500 at tier-3. More than 3,600 European firms buy directly from Taiwanese suppliers at tier-1, while over 68,000 buy indirectly at tier-2, and over 184,000 at tier-3. More than 1,200 companies in Japan and Singapore, along with Australia, buy directly from Taiwanese suppliers at tier-1, while over 11,300 buy indirectly at tier-2, and over 26,000 at tier-3. Electronic equipment and components, semiconductors, machinery, household durables, software, and chemicals are among the main industry segments represented in these trading relationships. These figures show the truly global reach of Taiwan’s industries and any disruption in their supply chains would inevitable have a ripple effect.

China’s relatively brief military exercises during Nancy Pelosi’s visit to Taiwan provided a number of pointers to the general cost (to China and the world) of an invasion or a blockade. Those exercises interrupted all shipping in an area of ocean that averages some 240 ships a day. A Chinese blockade, perhaps leading to an invasion, especially if it is contested by the United States, would stop all this shipping for an extended time and in so doing cripple China’s major ports of Shanghai, Delian, and Tianjin. It cannot but escape attention that the Taiwan Strait is a major conduit for all North Asia shipping to the rest of the world and the most direct route from South China to North America. It is estimated that just under half the world’s container ships passed through the strait this year, and 88% of the largest of these ships. Tankers carrying 1 million barrels of oil a day pass though that narrow body of water. There is no doubt that world trade would suffer, China’s especially.

India

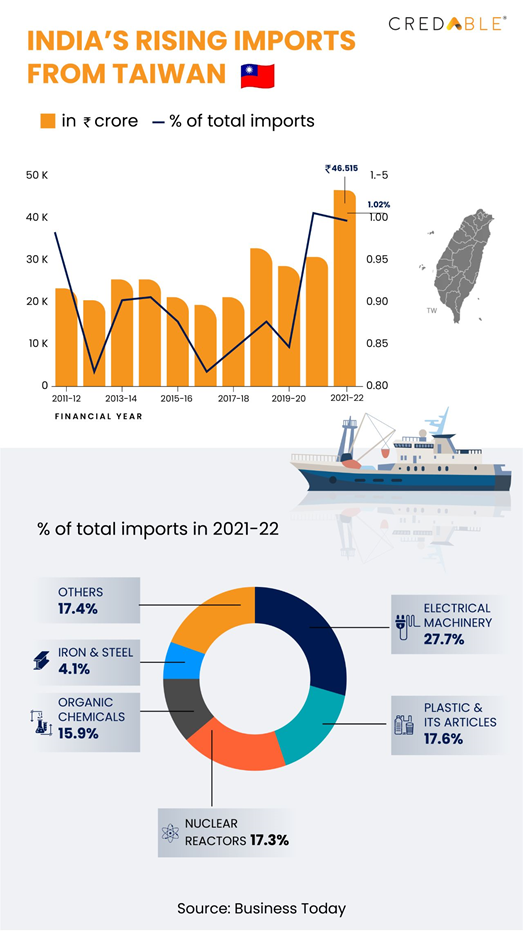

If China invades Taiwan, the US and other allies, including Japan, could militarily intervene, as well as impose economic sanctions on China, which would disrupt the supply chain. And in that case, India, along with other countries might face hyper-inflation, as the globe is largely dependent on China. In the event of a war, the Indian manufacturing sector will be directly affected as it imports a larger amount of raw materials and inputs from China, such as organic chemicals, fertilizers, and electrical components. India, like most of the world, is dependent on Taiwan for semi-conductor chips. An invasion of Taiwan is likely to influence India’s manufacturing supply chain, resulting in higher costs for automobiles, smartphones and medical devices, refrigerators, and washing machines. Recall that over 55% of India’s trade by volume passes through the South China Sea and blockage of the choke points to the north due to a conflict would severely impede this trade flow. More directly, India-Taiwan trade crossed the US$ 10 billion mark for the first time in 2022-2023.

Taiwan’s structural expertise in ICT based technology and semiconductor manufacturing has a direct bearing on various domains of the Indian economy. Any blockade of Taiwan by China in the event of a war would severely hamper India’s semiconductor imports and will have a detrimental effect on key economic sectors. Economic activities with Japan and South Korea would also be left in peril owing to the impassable Taiwan Strait.

Africa

No country in Africa, except for Somaliland recognises Taiwan diplomatically. Most countries on the continent are in relations with the PRC. Economic ties are strong as China has loaned considerable amounts of money to African countries. Of late, China has invested time and money in military bases in Africa, first in Djibouti and now possibly Equatorial Guinea. China is the African continent’s largest trading partner and source of foreign direct investment. Its investment has helped spur infrastructure development and economic growth. China’s need for oil and other resources and a market to sell its products has driven its investment in Africa. In the event of a blockade of Taiwan or an actual invasion, the African countries will probably abstain from criticising China.

While the impact of a conflict on the global supply chain, including that of semi-conductors will impact Africa, the continent will remain dependent on China. China is Africa’s largest two-way trading partner, hitting US$ 254 billion in 2021. China is the largest provider of foreign direct investment, supporting hundreds of thousands of African jobs. This is roughly double the level of U.S. foreign direct investment. While Chinese lending to African countries has dipped of late, China remains by far the largest lender to African countries. It is to be expected that China’s commercial activity in Africa would increase with the dramatic rise of its economy to become the second largest in the world, especially given China’s need for raw materials to support its very large manufacturing base. But this growth also represents a determined Chinese government-driven effort to make significant inroads in Africa. An invasion of Taiwan will slow down Chinese investment in Africa and reduce two-way trade. Further, China’s quest for raw materials will get suspended as sea trade is likely to be disrupted in the wake of a war.

South Asia

As seen above, the real focus of Taiwan’s exports are semi-conductors and South Asia also will be affected by a sudden invasion of the island by China. Currently, India and Bangladesh are the main recipient countries of FDI in South Asia. India’s FDI inflow stock increased from US$ 205 billion (US$ 275.2 billion) in 2010 to US$ 426 billion (US$ 572 billion) in 2019, whereas Taiwan has been emerged as an outward-looking economy where FDI outflow stock rose to US$362 billion (US$486 billion) in 2019 from US$190 billion (S$225.1 billion) in 2010. However, South Asia has been unable to attract Taiwan’s huge investment. Although trade complementarity between South Asia and Taiwan is very high, bilateral trade is only about US$ 9 billion (US$12 billion) and investment has increased only recently. Bilateral tariff eliminations between Bangladesh and Taiwan as well as between India and Taiwan have shown a positive economic gain in terms of welfare, real GDP, exports and imports. The exports of Bangladesh, India and Taiwan may increase by 0.82, 0.24 and 0.13 per cent respectively.

Given this background, it is unlikely that an invasion or blockade of Taiwan will impact South Asia in the short run. However, the gap between funding and realisation of debt in countries like the Maldives and Sri Lanka will intensify economic instability. The key industry of Taiwan’s exports to South Asia is semi-conductors and an impact on their exports would be one of the main aspects of a blockade of the Taiwan Strait.

Global South

The Global South refers to various countries around the world that are sometimes described as “developing,” “less developed” or “underdeveloped.” Many of these countries – although by no means all – are in the Southern Hemisphere, largely in Africa, Asia and Latin America. Here again, like in Africa, China has made deep inroads through the BRI and FDI.

Although Taiwan is undeniably a developing country in Asia, and is geographically situated in the northern hemisphere, it has always been viewed as bordering on the south.” Consequently, the notion of a “Global South” has been regarded as a “remote issue” for Taiwanese. The Global South, already burdened by higher energy prices and borrowing costs, would be disproportionately impacted by a Taiwan invasion. Fragile states who rely heavily on China, most notably, Pakistan, would be put under severe strain. In addition, a large basket of essential goods would see huge price shocks, the green energy transition, currently the only area of effective China-US cooperation, would be upended, and thousands of companies engaged in business in China directly or indirectly would face severe legal, regulatory, and supply chain issues.

Conclusions Strategic sense dictates that the first port of impact of any Chinese invasion of Taiwan would be China itself. Pertinently, Taiwanese buying in China has increased some 87% in the last five years. That is an average of 13.3% a year, a faster rate than most measures of bilateral trade anywhere in the world. At the same time, China has become increasingly dependent on Taiwanese products. Chinese imports from Taiwan have increased some 71 percent over the past five years. That is an average of 11.3 percent a year. More critical is the nature of China’s purchases from Taiwan. Some 64% are electrical machinery products, mostly semiconductors. This trade is vital to China, which at last measure could only produce some 10-15% of its silicon chip needs domestically. Taiwan, in fact, accounts for some 63% of the global contract manufacture of microchips, the lion’s share from a single company, TSMC. Taiwan accounts for some 92% of much sought-after miniature integrated circuits, those of less than 10 nanometers.