In Shanghai, rental demand for commercial office buildings recovered significantly in the fourth quarter of 2025. Chen Tong takes a closer look at the factors driving the increase.

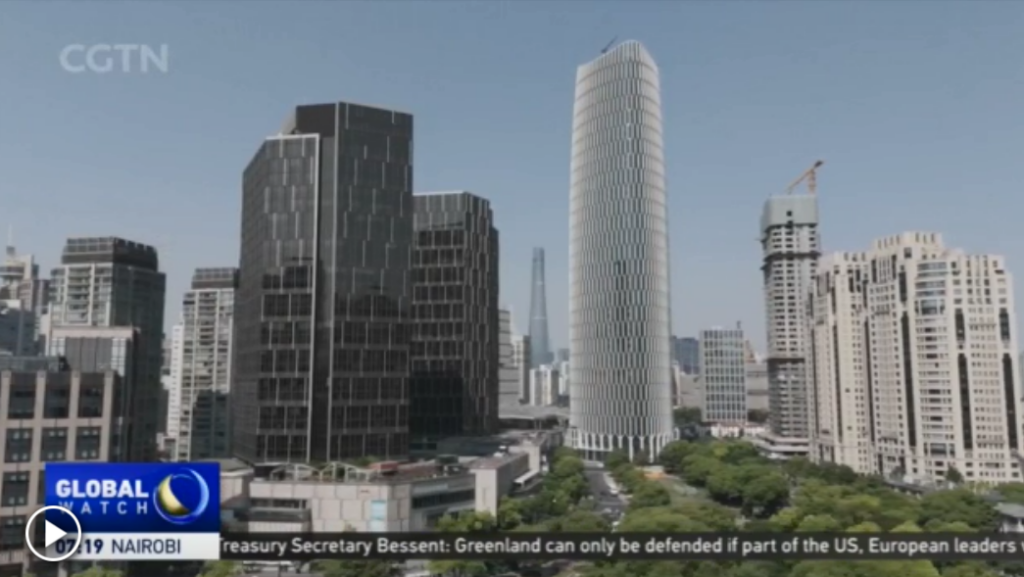

This is a landmark project in Shanghai’s city center. Covering an area of some 390,000 square meters, the development comprises three commercial office buildings.

CHEN TONG Shanghai “This property project is located in Xintiandi, one of Shanghai’s busiest commercial districts. So far, more than 60 percent of its space has already been rented, mostly by leading and well-known foreign companies.”

BRUCE DAI Deputy General Manager, Office Business Management Shui On Xintiandi “The Huangpu district is a core CBD area. It’s not like a one or two single industries we are focusing. Instead, we have a lot of top-tier companies in different industries.”

Data from real estate consultancy Knight Frank show that 63 percent of the firms renting offices in Shanghai in the fourth quarter of 2025 were domestic firms, up four percentage points from a year earlier.

However, in core areas like Xintiandi, international companies remain a major renting force.

BRUCE DAI Deputy General Manager, Office Business Management Shui On Xintiandi “The completion of the office part is in 2024. We only took one and half year to lease out whole three office buildings to 65 percent average of occupancy rate. So I think we are doing pretty well facing the challenging market.”

Shanghai’s office building market has indeed been challenging. The city’s net absorption in Grade-A office buildings – which refers to net change in occupied space – dropped by nearly 11 percent in 2025 from a year earlier. Net absorption recovered in the fourth quarter of 2025 – jumping by 9.3 percent quarter-on-quarter.

VIRGINIA HUANG Managing Director, North and East China Knight Frank “We think this is an early sign showing the market recovery backed by the resilience of China economy. Looking at the supply side, the last quarter’s new supply recorded at 216,000 square meters, it was also up by 55 percent. So it pushed up the vacancy rate by 0.5 percent and reach to historic high at 23.8 percent. So this marginal improvement actually shows the tenant demand is beginning to stabilize.”

The situation is not unique to Shanghai. Other first-tier cities like Shenzhen saw net absorption in Grade-A office buildings hitting a four-year high in 2025. In Beijing, net absorption was up by ten percent in the fourth quarter of last year. And this trend, industry insiders believe, could signal that demand for commercial office space is gradually stabilizing after suffering a sharp decline over the past few years. Chen Tong, CGTN, Shanghai.