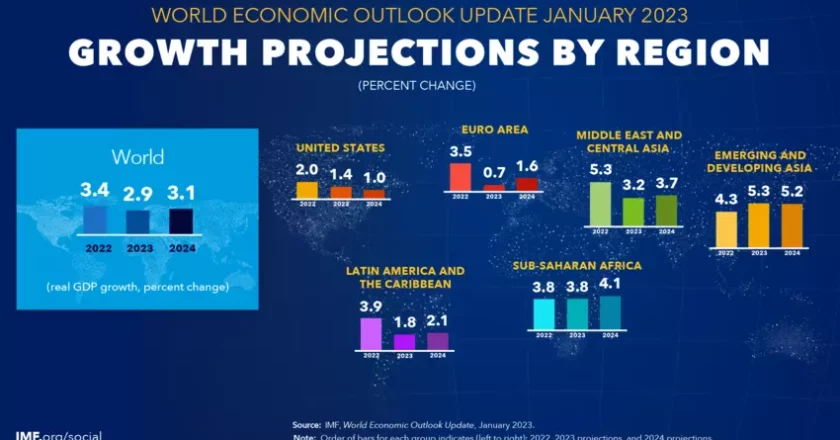

A “Lost Decade” for Global Economic Potential, according to the World Bank

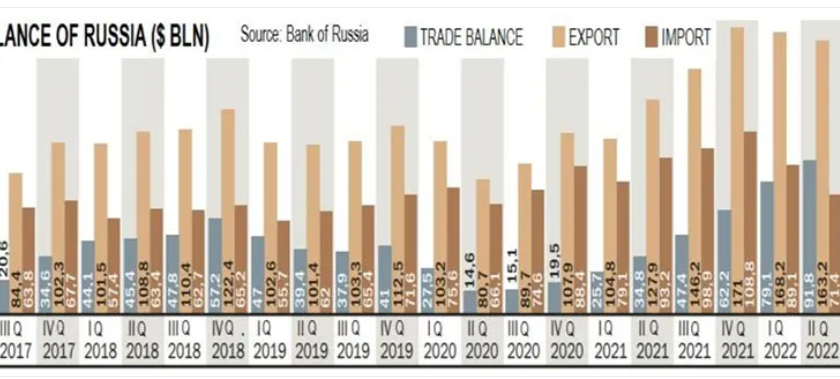

The World Bank has issued a warning that the coronavirus pandemic, along with Russia's conflict in Ukraine, has led to a drop in the global economy's potential for long-term growth.

The situation could result in a "lost decade", which would leave fewer resources for addressing climate change and an increase in poverty. This is occurring alongside banking crises that pose a threat to global economic growth.

The World Bank's latest report predicts that potential global output will reach a 30-year low of 2.2 percent per year between 2023 and 2030, with developing economies expected to experience an even greater decline, falling from an average annual rate of 6 percent to 4 percent.

World Bank officials have cautioned that the "golden era" of development appears to be coming to an...