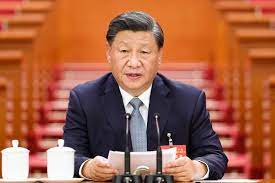

Oil price sliding down as China continues zero covid policy

SINGAPORE -

Brent crude futures dropped US$1.20, or 1.2 per cent, to US$97.37 a barrel by 0227 GMT, after hitting as low as US$96.50 earlier. US West Texas Intermediate (WTI) crude was at US$91.24 a barrel, down US$1.37, or 1.5 per cent, dropping to a session low of US$90.40 a barrel earlier.

“Oil prices dropped sharply as Chinese officials vowed to stick to the Covid-zero policy while infected cases climbed in China, which may cause more restrictions.... darkening the demand outlook,” CMC Markets analyst Tina Teng said.

Four Federal Reserve policymakers last Friday indicated they would still consider a smaller interest rate hike at their next policy meeting despite strong jobs data.

Brent and WTI rose last week, up 2.9 per cent and 5.4 per cent respectively, as rumours of a p...