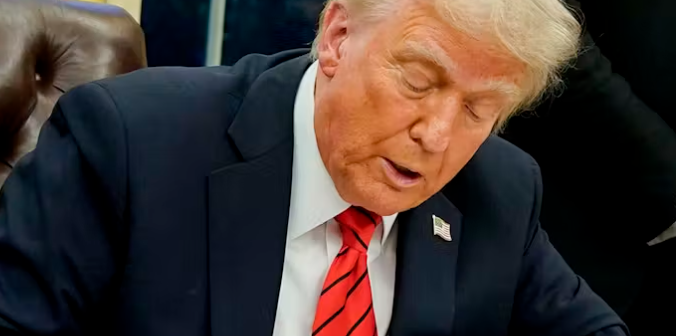

Details of Scott Bessent Trump’s Plan to Restructure the American Economy

In his first major economic policy address as U.S. Treasury Secretary, Scott Bessent laid out the Trump administration’s ambitious plan to transition the American economy away from government dependence and toward private sector-driven growth. Speaking at the Economic Club of New York, Bessent made it clear that President Donald Trump intends to roll back financial regulations, implement permanent tax cuts, and use tariffs as a strategic tool to strengthen American industry. His remarks signaled a significant shift in economic policy—one aimed at reversing what he described as the “overreach” of the previous administration.

A Return to Private Sector GrowthBessent emphasized the need to reduce government intervention in the economy, arguing that the previous administration’s policies h...