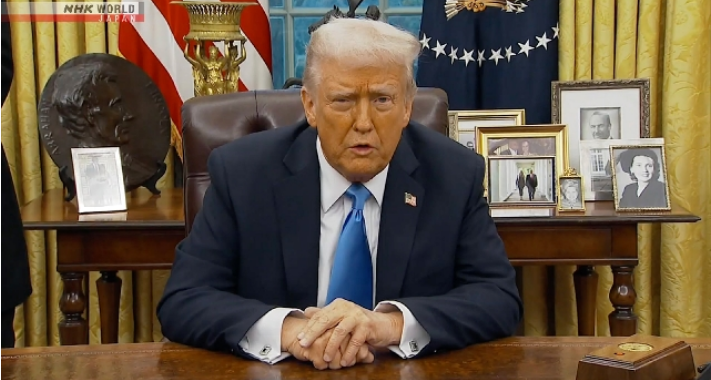

Trump claims that four US groups are looking to purchase TikTok.

Four different groups are seeking to take over TikTok, the social media giant owned by China’s Bytedance, according to US President Donald Trump.

Trump said his administration is in contact with the different groups about the sale of the social media platform, and described all the options as good.

The fate of TikTok’s American unit has been up in the air since a law requiring its owner ByteDance to either sell it on national security grounds or face a ban took effect on January 19.

Trump, after taking office on January 20, signed an executive order seeking to delay by 75 days the enforcement of the law.

Asked if there was going to soon be a deal on TikTok, Trump told reporters aboard the Air Force One, “it could”.

“We’re dealing with four different groups, and a lot of peo...