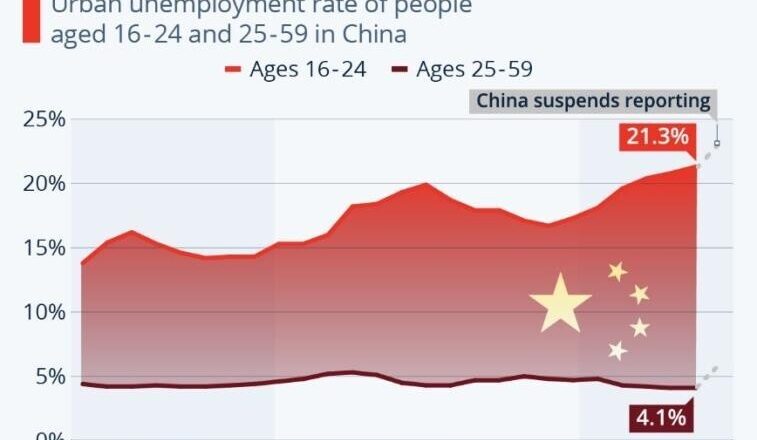

Did Authoritarianism Cause China’s Economic Crisis?

China’s economy, the world’s second largest, is facing its most serious setback in a generation. During the past two years, economic growth appears to have been cut nearly in half. After emerging from the “zero covid” policies that Xi Jinping, China’s leader, ordered early in the pandemic, the country now faces a real-estate crisis and faltering confidence from both its own citizens and overseas businesses. The problems have sparked debate among economists about whether Xi’s increasingly autocratic regime is to blame, and what a major slowdown could mean for the rest of the world.

To talk about China’s economy and the possible causes of its malaise, I recently spoke by phone with the economist Eswar Prasad: a professor at Cornell University and a senior fellow at the Brookings Institut...