Asia in denial

I saw nothing but denial in my recent post-US election tour of Asia, with stops in Hong Kong, Shenzhen, Beijing, and Singapore. Taking a cue from surging global equity markets, Asians are making every effort to wish away problems at home and abroad.

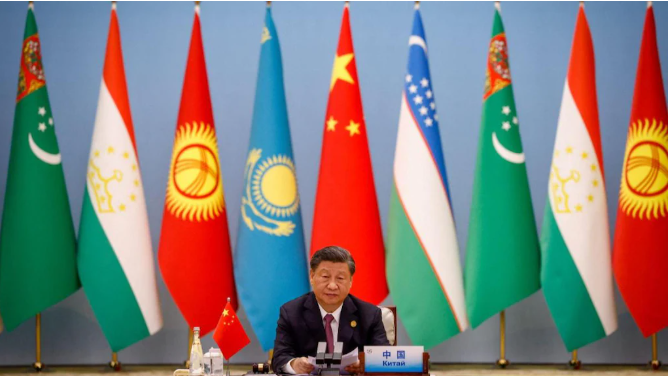

Nowhere is this more evident than in China. President Xi Jinping has long stressed his preference for the “good stories of China” (bit.ly/3Z8EI75). Amid the most serious Chinese economic slowdown since the 1970s, government attempts to put a positive spin (bit.ly/3Ozky0R) on the country’s outlook have intensified. An improvement in equity-market sentiment (bit.ly/4fL6ZaO) — by October 8, the CSI 300 was 35% above its low on September 13 — was the first talking point in all my discussions. Never mind that this rebound, which has si...