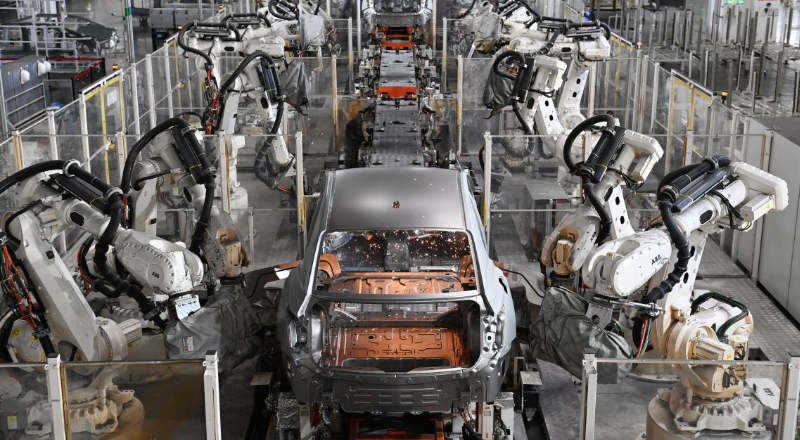

Following a vote, an EU executive is ready to impose duties on Chinese electric vehicles.

The European Commission said on Friday it had received enough support in a vote of EU members to impose tariffs of up to 45% on imports of Chinese-made electric vehicles in the bloc's highest-profile trade case, risking retaliation from Beijing.

France-based broadcaster Euronews cited diplomatic sources as saying that Poland voted in favor of the move, but Germany, the region's biggest economy and major car producer, opposed it.The European Commission, which oversees the bloc's trade policy, has proposed final duties for the next five years to counter what it sees as unfair Chinese subsidies after a year-long anti-subsidy investigation.In a vote on Friday, 10 EU members backed tariffs and five voted against, with 12 abstentions, EU sources said.It would have taken opposition from a qua...