China boosts markets by promising to provide further economic help.

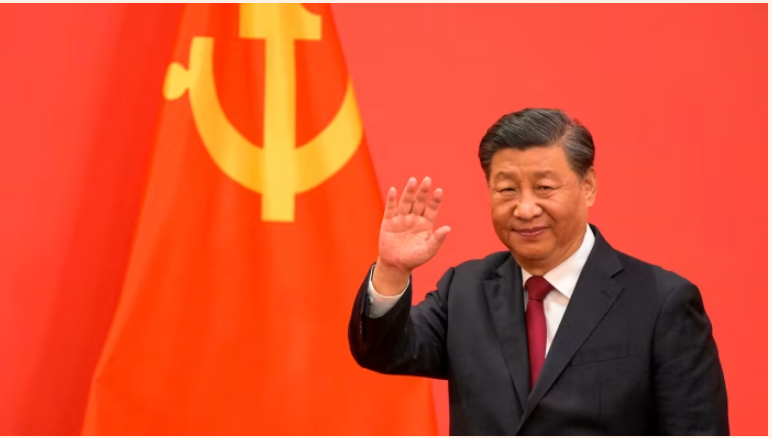

China’s leaders have vowed to intensify fiscal support for the world’s second-largest economy, fuelling markets with hopes of more intervention just days after the central bank announced the biggest monetary stimulus since the pandemic. The politburo, led by President Xi Jinping, pledged on Thursday to “issue and use” government bonds to better implement “the driving role of government investment”, in comments that come as analysts warn that China is in danger of missing its official economic growth target this year. The politburo usually does not hold economic sessions in September, suggesting “an increased sense of urgency” about growing deflationary pressures, Morgan Stanley analysts said. But they said China’s government did not yet appear to have reached a “whatever it takes” moment ...