China’s third plenum is unlikely to significantly correct an ailing economy

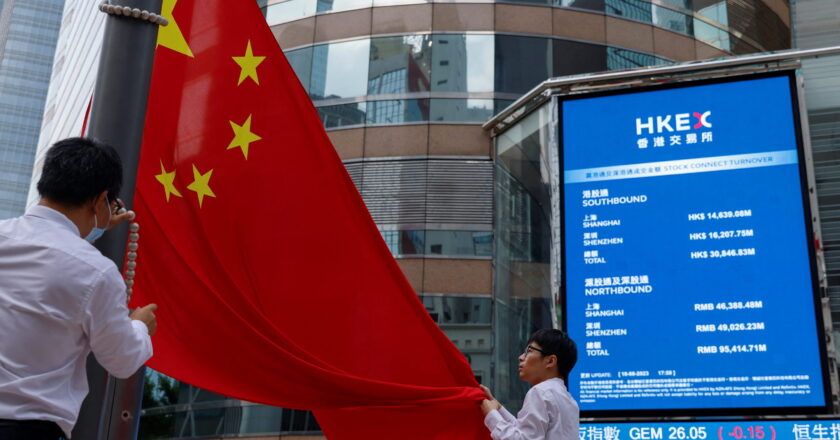

China’s third plenum, taking place in Beijing from 15 to 18 July, is a once-in-every-five-years conclave of the Central Committee of the Chinese Communist Party, where a range of policies to address long-standing issues are unveiled. Historically, this event has seen announcements of major policy shifts and economic reforms. This time around, markets and China watchers hope the third plenum can answer a specific question: will sufficient growth-enhancing measures be announced to revive the Chinese economy after years of underwhelming performance?

The party’s official channels have been previewing the third plenum as a platform for “comprehensive” reforms, but foreign observers and some academics are not convinced. Increasingly serious problems have been piling up fo...