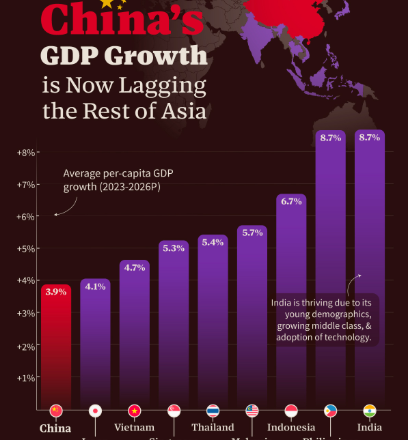

China is now behind the rest of Asia in GDP growth.

China’s GDP Growth is Now Lagging the Rest of AsiaThis was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

China’s economy is facing a series of significant challenges, including a property crisis and high youth unemployment. After decades of rapid growth, the country is now expected to experience less economic growth than other Asian nations.

This graphic illustrates the projected growth of per-capita GDP for selected Asian nations between 2023 and 2026, based on data compiled by HSBC as of November 2024.

Chinese Economy LaggingIndia and Southeast Asian nations are projected to achieve an average per-capita GDP growth of 6.5% over the 2023–2026 period.

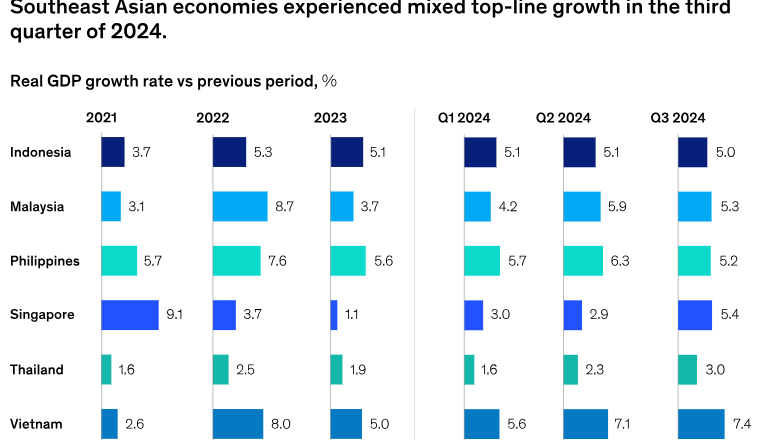

Most of these...