A new dollar bloc: Reglobalization in the face of United States-China hostilities

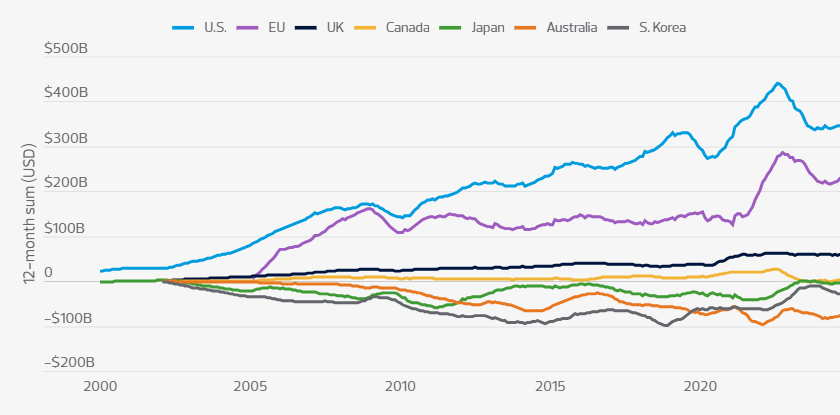

The fragmenting of free trade and the rise of industrial policy have resulted in the nascent formation of a trade, finance and currency bloc organized around American economic and security interests.

Although not formalized, the democracies in the West and their primary trading partners in Asia, excluding China, appear to be coalescing around mutual economic and security interests in a de facto dollar bloc, with the U.S. Federal Reserve as the lender of last resort.

A trading bloc of democracies would include more than 56% of the world’s gross domestic product. China, by contrast, has a 16.8% share of world GDP, while India has 3.4% and Russia 1.9%.

In some respects, this dollar bloc evolved out of the crucible of the 2008−09 financial crisis and lessons learned around supply cha...