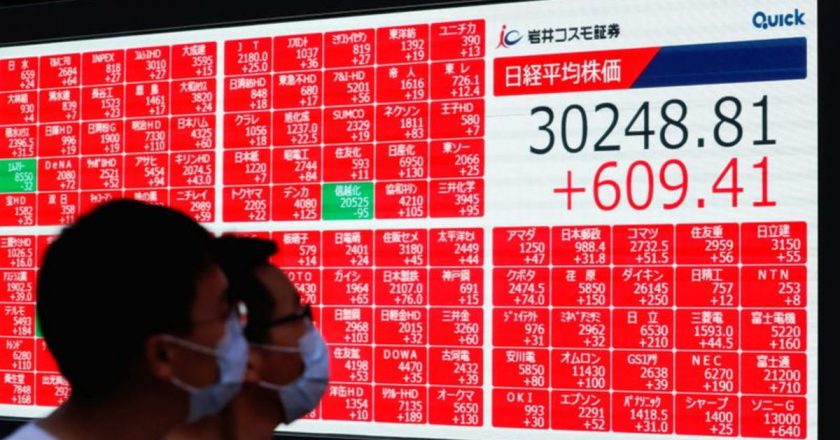

Dollar strength holds back Asian FX; rupee bears re-emerge: Reuters poll

Investors raised short bets on most Asian emerging currencies, a fortnightly Reuters poll found, as a slew of factors including U.S. rate-hike expectations, rising inflation and signs of slowing global economic growth boosted the dollar.

Long positions on the Singapore dollar, Taiwan's dollar and the Indian rupee were reversed, while bearish views on the South Korean won hit a two-year peak, the poll of 12 respondents showed.

The Indonesian rupiah was the only currency with a bullish trend, although long bets were almost halved.

The safe-haven greenback has risen to a one-year high since the Federal Reserve's hawkish tilt two weeks ago led markets to price in a rate hike sometime in 2022, with sharp gains in benchmark Treasury yields adding to its appeal.

The dollar is expected to domi...