South Asian economies face both challenges and possibilities in the future.

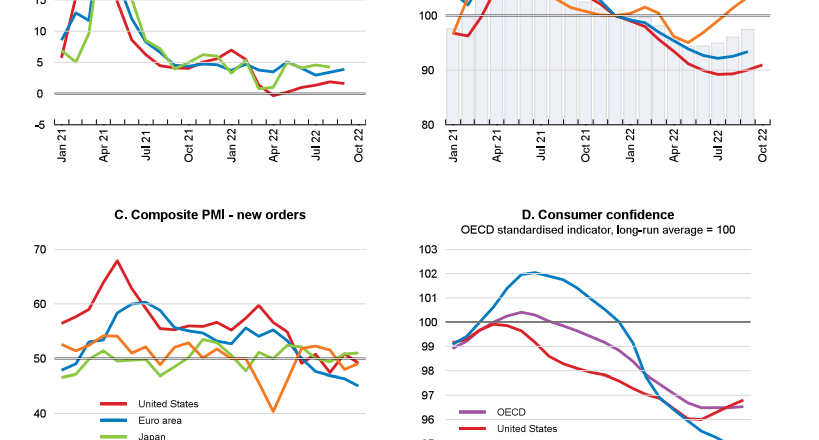

South Asia, battered by three years of upheaval from the COVID-19 pandemic and spillovers from Russia’s invasion of Ukraine, faces a combination of good and bad news for its economies. On the positive side, global energy and fertilizer prices are down, both tourism and business services continue to recover strongly, and the reopening of China’s economy is relaxing supply bottlenecks. However, rising interest rates and risks in the banking sector in the United States and Europe have increased uncertainties in South Asia’s outlook, given their significant impact on balance of payments, exchange rates, and financial markets

Therefore, growth in South Asia is expected to slow down in 2023, according to our latest South Asia Economic Focus (SAEF) , Expanding ...